By Jock Finlayson, ICBA Chief Economist

The Canadian construction industry has been forced to navigate fast-rising costs and a more complex operating environment over the past several years. Recent data point to a moderation in the pace of cost increases, but both residential and non-residential construction price indexes continue to climb at rates that exceed overall inflation.

Statistics Canada data through the end of June 2024 show residential building costs up by 0.8% in Q2, down slightly from the 1.0% q/q increase reported in Q1. On the non-residential side, building costs were up 1.1% in Q2 (vs. 1.0% in Q1). Year-over-year, residential construction costs in “urban” Canada were 4.2% higher than they were in the second quarter of 2023, while non-residential building costs were 4.3% higher.

Turning to large urban centres in B.C. and Alberta, residential construction costs in Metro Vancouver in Q2 were 6.1% higher than a year before, vs increases of 7.3% in Calgary and 3.2% in Edmonton. The Q2 non-residential building price index was 5.1% higher in Vancouver on a year-over-year basis, compared to y/y increases of 5.0% in Edmonton and 4.0% in Calgary.

Turning to large urban centres in B.C. and Alberta, residential construction costs in Metro Vancouver in Q2 were 6.1% higher than a year before, vs increases of 7.3% in Calgary and 3.2% in Edmonton. The Q2 non-residential building price index was 5.1% higher in Vancouver on a year-over-year basis, compared to y/y increases of 5.0% in Edmonton and 4.0% in Calgary.

While the earlier upward pressure on costs may have diminished, inflation in the construction sector is still more pronounced than in many other parts of the Canadian economy. Some segments of the construction industry continue to grapple with labour shortages and supply chain challenges. The recent weakness of the Canadian dollar is also a factor, as it pushes up the cost of imported building materials. Government policies, regulations and bureaucratic processes are also an increasingly important cost driver for all parts of the industry.

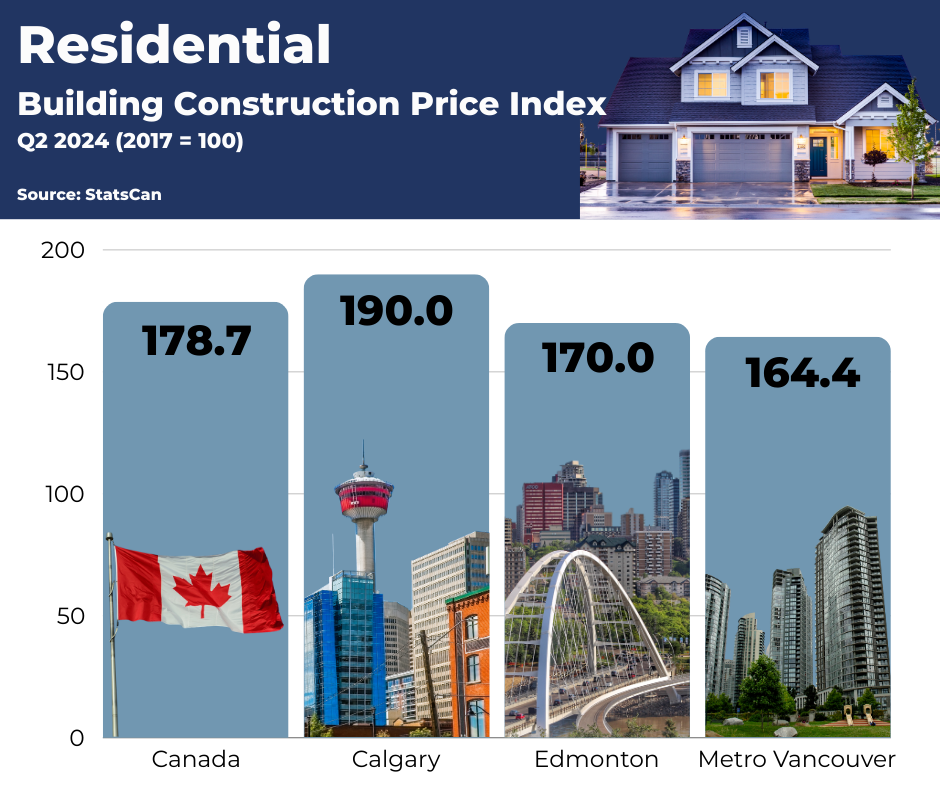

The accompanying figures show the 2024 Q2 construction price index figures for both residential and non-residential building for cities in Alberta and B.C., and for metropolitan Canada, benchmarked relative to 2017=100. Compared to 2017, residential building costs are now 90% higher in Calgary, 70% higher in Edmonton, and 64% higher in Metro Vancouver. For the 11 city Canadian composite, the cumulative increase is almost 79%. Non-residential construction has faced somewhat less powerful but still significant cost escalation.

The accompanying figures show the 2024 Q2 construction price index figures for both residential and non-residential building for cities in Alberta and B.C., and for metropolitan Canada, benchmarked relative to 2017=100. Compared to 2017, residential building costs are now 90% higher in Calgary, 70% higher in Edmonton, and 64% higher in Metro Vancouver. For the 11 city Canadian composite, the cumulative increase is almost 79%. Non-residential construction has faced somewhat less powerful but still significant cost escalation.

With the Canadian 2022-24 inflation shock now in the rear-view mirror, the macroeconomic environment is now more conductive to cost containment in the broad business sector. However, construction looks to be something of an exception, given the historically elevated levels of building costs and continued upward pressure on some categories of building costs.