By Jock Finlayson, ICBA Chief Economist

Construction is a big and unusually visible segment of our economy, one that in some of the industry’s busiest years accounts for more than 8% of economic output (GDP) and for a similar share of all jobs in Canada. It is a major source of investment spending and an important domestic customer for the goods and services produced by other Canadian industries, including building and other construction materials, architecture and design, transportation and logistics, and a host of financial, technical, engineering, and other professional services.

Statistics Canada defines the construction sector as consisting of “business establishments primarily engaged in constructing, repairing and renovating buildings and engineering works, and in subdividing and developing land.”

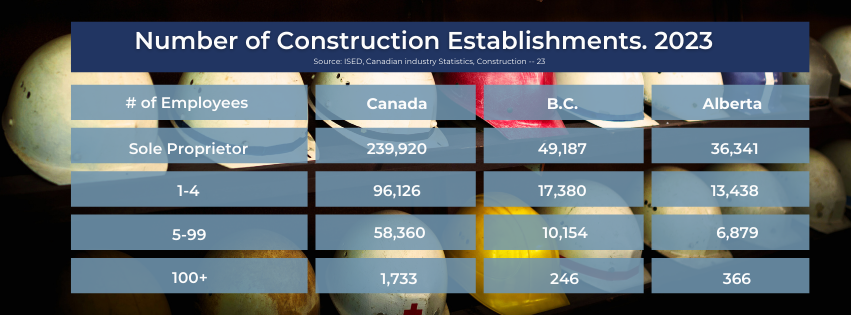

Nationally, there were 156,219 construction business establishments with paid employees in 2023. British Columbia was home to 18% of these and Alberta to 13%. Many other construction businesses are one-person operations with no other employees. Adding the two together – businesses with and without paid employees – Canada had a total of 396,139 construction establishments in 2023.

Figure 1 breaks down construction businesses based on number of employees for Canada, B.C. and Alberta in 2023. It should be noted that a sizable majority of construction firms are “micro-businesses” (less than five employees), while 37% have 5-99 employees. Just 1% of construction companies in Canada employ 100 or more people.

Construction makes a significant contribution to overall economic output or GDP. In 2023, construction sector GDP reached $164.7 billion, measured in 2017 dollars. That amounted to 7.5% of total Canadian GDP – a slightly smaller share than normal. The slowdown in economic activity in the construction sector last year reflected lower housing starts and reduced private sector construction activity amid a slumping Canadian economy, escalating building costs, skyrocketing interest rates, and stubbornly high inflation.

Main Industry Components

Analysts typically divide the construction sector into three or four components: building construction (with the residential and non-residential segments sometimes separated); heavy and civil engineering construction; and specialty trades.

Building construction is made up of businesses that construct new and rehabilitate or modify existing buildings – both residential and non-residential (with the latter divided into commercial, industrial and institutional). Canada had 133,706 construction businesses in this part of the industry in 2023, of which 99% had fewer than 100 employees.

Heavy and civil engineering construction is comprised of businesses involved in all types of engineering work, including maintenance and repair of existing structures and the building of new structures/facilities. Land development is also included in this segment of the industry. In 2023, there were 36,385 businesses in the heavy and civil engineering construction sub-sector, of which 94% have fewer than 100 employees.

Finally, specialty trades contracting encompasses a large group of establishments that provide trade services to firms that construct or otherwise work on buildings and other structures. Examples of specialty contractors are those which do painting, electrical work, finishing, and masonry. This work may involve new construction as well as additions, alterations, maintenance, or repairs. Specialty contractors normally work under contract for general contractors and are responsible for a particular piece of a larger project or undertaking. There were 226,048 businesses classified as specialty trade contractors in Canada in 2023, with 99% of these being small (0-99 employees).

Looking Ahead

ICBA Economics sees a bright future for the Canadian construction industry, notwithstanding the economic challenges facing the country (e.g., waning global competitiveness, stagnant productivity and a rising regulatory burden). In part this is because we expect Canada’s population will continue to grow at rates in excess of other advanced economy jurisdictions; this demographic dynamic will boost the need and demand for all types of construction.

Construction will also get a lift from the renewed focus of governments across the country on accelerating the development of housing supply, as seen in the federal government’s 2024 Housing Plan.

Canada’s large and growing “infrastructure deficit” is a third reason why the construction sector should benefit from rising demand in the coming decade.

Finally, hundreds of billions of dollars of planned/future investment spending tied to the “energy transition” and to the climate policy targets and programs adopted by governments will also filter down to the construction sector, in different ways. This trend will be evident in the need to: i) expand the generating capacity of electricity systems in all provinces; ii) bolster the resiliency of roads, wastewater systems, and other physical infrastructure judged to be vulnerable to climate impacts; iii) decarbonize existing industrial operations (where possible); and iv) reduce emissions from the building sector.

Against this backdrop, we anticipate that the construction industry’s shares of both GDP and employment in Canada will edge higher over the balance of the decade and into the 2030s.