The following was sent to Ministers Katrine Conroy, George Heyman, and Josie Osborne, on Oct. 24, 2023.

Re: Submission to the Provincial Government on the proposed British Columbia oil and gas emissions cap policy paper (OGECPP)

Dear Ministers,

The Independent Contractors and Businesses Association (ICBA) welcomes the opportunity to provide comments and recommendations on the provincial government’s proposed B.C. Oil and Gas Emissions Cap Policy Paper (OGECPP).

As you may be aware, ICBA is the largest construction association in Canada, representing more than 4,000 members and clients, including many in the responsible resource development sector. ICBA is one of the leading independent providers of group health and retirement benefits in western Canada, supporting more than 150,000 Canadians, and the single largest sponsor of trades apprentices in B.C.

ICBA members and the broader B.C. business community recognize the importance of addressing greenhouse gas (GHG) emissions and preparing for a shifting climate. This requires increasing resource use efficiency across all segments of the economy; advancing and adopting technologies that reduce the carbon intensity of industrial activity, transportation, power generation, and the heating and cooling of buildings; and investing to fortify and improve physical infrastructure deemed to be at risk of extreme weather events and other potential consequences of climate change.

At the same time, as a small, trade-dependent province that is already a relatively low carbon jurisdiction by North American standards, B.C. must aim to strike a balance in setting climate and industrial development policies – one that seeks to ensure that actions taken to reduce GHG emissions do not come at the cost of a prosperous and growing economy or undercut the competitive position of our major export industries. Policy choices and policy design matter, and the decisions of government can have significant consequences for the jobs, incomes and future prosperity of British Columbians.

The government previously released the Output Based Pricing System Technical Paper (OBPS) and the Net-Zero New Industry Intentions Paper. ICBA has examined both documents (although we did not make submissions on them). We share the concerns of the Business Council of British Columbia about the near- and medium-term economic implications of the government’s existing suite of CleanBC policies and the additional measures proposed in the above-noted consultation papers.[1] As highlighted by the Business Council, the economic modelling commissioned (but not publicly released) by the province has identified the heavy costs that will be imposed on households and businesses in British Columbia as a result of current provincial climate policy, including the wholly unrealistic emissions reduction targets planned for 2030 – now less than seven years away.

The government’s own modeling implies that economic growth in B.C. will grind almost to a halt over the second half of the decade as the carbon tax rises from $65/tonne in 2023 to reach $170/tonne by 2030, and the government simultaneously implements more stringent regulations and sector-specific emissions caps on some B.C. industries. The modelling points to an overall economic cost equivalent to $4,600 per person, attributable to slower economic growth and (much) higher energy and energy input costs for domestic households and businesses. In fact, prosperity – as defined by real per capita income – is projected to regress to its 2013 level by the end of the decade under the existing CleanBC plan. This is not an acceptable outcome for British Columbians, and it hard to imagine elected representatives willfully and knowingly adopting a mix of policies and regulations that promise to put our economy on such a steep downward path.

ICBA believes a fundamental re-think of CleanBC is necessary. This should include recalibrating the timelines for reducing GHG emissions, which in truth have barely budged since 2010 – despite B.C. having the first and highest carbon tax in North America for the past 15 years. Aiming to slash GHG emissions by 40% within just a few years is neither realistic nor wise. B.C. policymakers must establish conditions that support healthy economic growth to attract investment, provide people with opportunity, realize the goals of Indigenous economic reconciliation, and sustain and grow the province’s leading export industries – industries that are central to maintaining and improving prosperity. CleanBC falls short on all of these metrics.

Turning to the OGECPP, we submit that a plan to cap emissions for the oil and gas industry is unnecessary. As noted above, B.C. was the first jurisdiction in North America to introduce an economy-wide carbon tax. A broadly applied carbon tax is acknowledged by economists around the world to be the most cost-effective approach for reducing greenhouse gas emissions, particularly when implemented alongside a commitment to aggregate revenue neutrality (a principle enshrined in law in 2008 but which your government has abandoned)[2]. Along with carbon pricing, a well-designed output-based GHG management system for energy-intensive industries – along the lines of those in Ontario, Quebec, California, and Alberta as well as the scheme adopted by the Canadian government – can safeguard B.C.’s industrial and export competitiveness while still spurring and incentivizing emissions reductions. There is no need for a sector based GHG “cap” for any B.C. industry, including oil and gas.

This position is consistent with the advice of respected Canadian economists who support strong action on climate change and favour policies geared to delivering cost-effective reductions in GHG emissions.[3] Economic experts generally agree that climate policies which focus on individual regions or industries come at a relatively high cost per unit of avoided emissions, particularly compared to a carbon tax. Economic resources are limited, even in an affluent jurisdiction like B.C. It does not make sense to “pay for” policies that seek to advance important objectives at a higher-than-necessary societal cost. Yet that is what an oil and gas emissions cap will do.

ICBA is concerned that CleanBC, in its present form, together with the proposed oil and gas emissions cap, will cripple large parts of B.C.’s industrial economy, including the energy sector which now accounts for more than one-third of the province’s merchandise export revenues.[4] This concern was also expressed in a detailed Bank of Montreal equity analysts’ report dated September 5, 2023.[5] It concluded that B.C.’s current policy approach will “make further development… potentially uneconomic for much of B.C. industry.” We assume this is not an outcome sought by provincial policymakers.

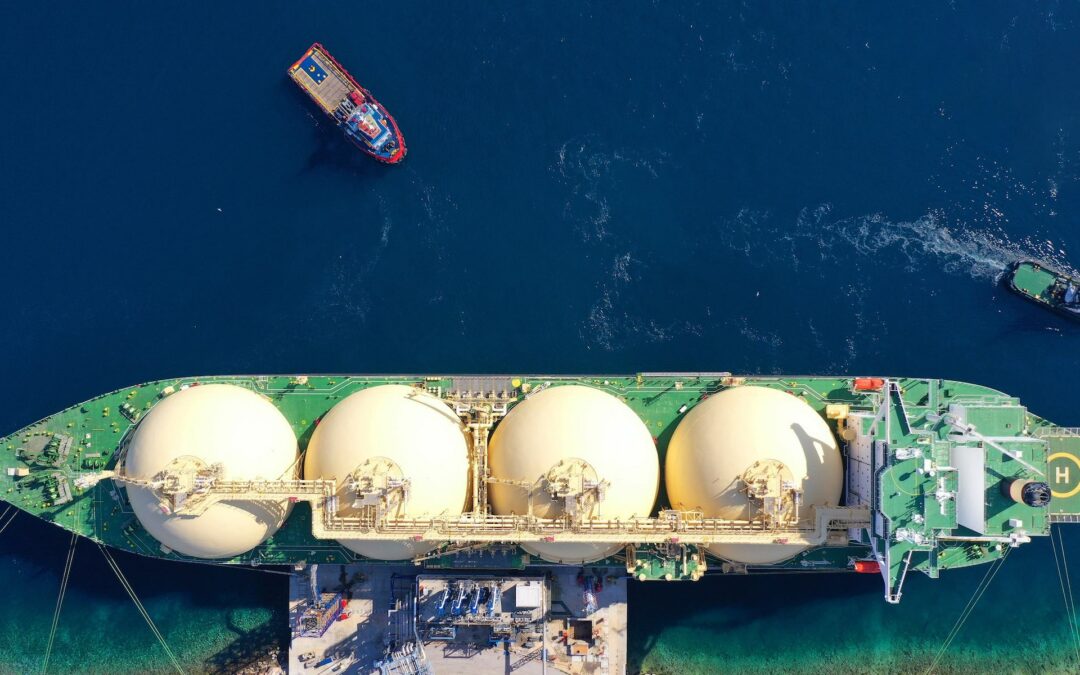

The proposals in the OGECPP, notably the requirement to slash oil and gas sector emissions by 33-38% from 2007 levels by 2030, will lead to a significant contraction of output, investment, and exports in the fossil fuel sector, despite the anticipated increase in upstream natural gas production needed to support the emerging B.C. LNG industry – an industry that did not exist in 2007. Implementing the OGECPP proposals as written will shrink the B.C. oil and gas industry and re-direct both capital investment and future production growth away from our province to other jurisdictions in the U.S., Canada and abroad. This kind of “carbon leakage” will do nothing to reduce global GHG emissions, but it will inflict real and lasting harm on the B.C. economy. Of interest, the U.S. government’s Energy Information Administration forecasts that U.S. natural gas production will grow by 5% this year and another 2% in 2024.[6] The projected increase in U.S. natural gas output over 2023-24 approximately matches total annual B.C. natural gas production. This underscores the important point that B.C. – and indeed Canada – represents a very small part of the global energy system. If the hosting conditions for the oil and gas industry in B.C. further deteriorate, the result will be more oil and gas production and increased energy-related capital investment flowing to other jurisdictions, with no net benefit to the global climate.

ICBA believes that through meaningful consultation with industry, a willingness to recalibrate some existing policies, and the adoption of realistic rather than politically-driven timelines for reducing emissions, B.C. can make progress on decarbonization in a cost-effective manner, while increasing rather than decreasing GDP and income per capita. This will require policy commitments to expand access to electricity, accelerate the development and take-up of innovative low-carbon technologies, and modernize and streamline current project assessment and permitting regimes. Industries that generate GHG emissions – including the oil and gas sector — must be given time and appropriate policy supports to facilitate the transition to a lower-carbon future.

ICBA appreciates the opportunity to provide comments on the proposed oil and gas emissions cap.

Yours sincerely,

Chris Gardner

President

Independent Contractors and Businesses Association

[1] Business Council of B.C., “Submission to the B.C. Government on the Output-Based Pricing System Technical Background Paper,” September 6, 2023; and “Submission to the B.C. Government on the New Zero New Industry Intentions Paper,” August 24, 2023; both available at www.bcbc.com

[2] For a comprehensive and up-to-date review, see Gilbert Metcalf, “Carbon Taxes in Theory and Practice,” Annual Review of Resource Economics, 2021.

[3] See, for example, Trevor Tombe,” Capping oil and gas emissions is a bad idea,” The Hub, April 20, 2023; and Chris Ragan, Paul Rochon, and Marc Jaccard, “The excessive cost of phasing out Canada’s oil and gas production,” The Hub, June 10, 2023.

[4] In 2022, energy accounted for 37% of the value of B.C.’s merchandise exports, with natural gas alone accounting for 12%. See BC Stats, Annual B.C. Origin Exports, February 7, 2023. Both of these figures will increase once LNG Canada’s facility in Kitimat commences production.

[5] BMO Capital Markets, No Summer Luvin’ From B.C. as Industry Told it Better Shape Up, September 5, 2023.

[6] Energy Information Administration, “Short-Term Energy Outlook,” 2023.