VANCOUVER, B.C. — Today, the Greater Vancouver Board of Trade (GVBOT) and the Independent Contractors and Businesses Association (ICBA) released an independent survey of business owners on the impacts of the B.C. government’s new Employer Health Payroll Tax, which was unveiled in BC Budget 2018-19 in February.

According to our survey results, small- and medium-sized businesses will bear the brunt of the new Employer Health Payroll Tax. The survey — conducted by Mustel Group between March 21 and April 4, 2018 — consisted of an association member sample of both organizations.

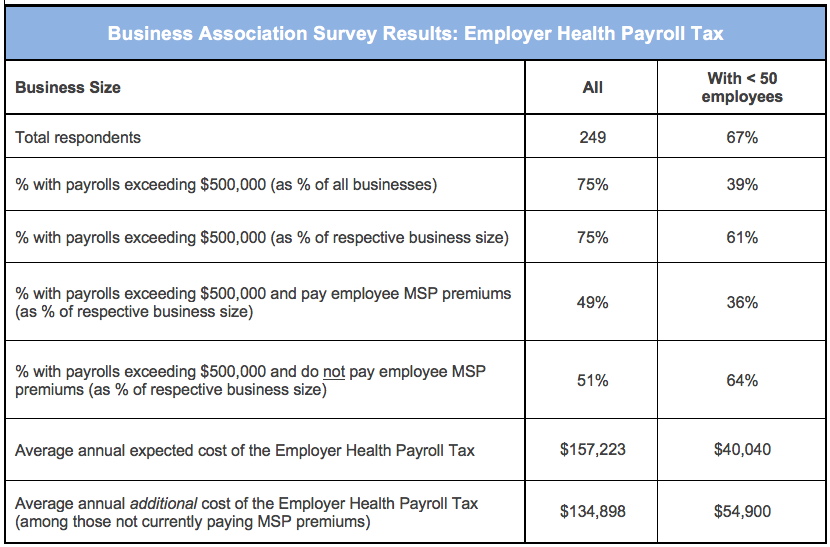

Businesses with fewer than 50 employees are defined as small businesses in British Columbia. Those with payrolls of $500,000 or higher will be subject to the Employer Health Payroll Tax, which takes effect on January 1, 2019.

Many of our members are established businesses who employ British Columbians in the Greater Vancouver area and around the province, creating jobs and contributing to their communities. More than 60 per cent of our respondents who are small businesses expect to pay the tax. Among the overall membership of our organizations, 75 per cent say they have payrolls exceeding $500,000 and will be affected by the tax.

In response to the new Employer Health Payroll Tax and in the face of rising taxes and operating costs, our member businesses clearly tell us they will take a variety of measures, including reducing staff and/or reduce benefits.

Key findings include:

- 61 per cent of our member businesses with fewer than 50 employees will pay the tax.

- 36 per cent of our member businesses with fewer than 50 employees presently pay MSP premiums on behalf of their employees. They will be “double-taxed” for one full year, since the Employer Health Payroll Tax takes effect January 1, 2019, but MSP premiums do not end until December 31, 2019.

- 49 per cent of association members who meet the $500,000 payroll threshold will experience this “double-taxation” through 2019.

- 64 per cent of our member businesses with fewer than 50 employees do not presently pay their employees’ MSP premiums, but will be required to budget and pay for a brand new tax when it takes effect January 1, 2019, while their employees will still be paying MSP.

- The average annual payroll tax bill reported by respondents to our association member survey is $157,233.

- For the 51 per cent of member businesses currently not paying MSP premiums that will now have to, the additional tax will be an average of almost $135,000. Businesses with less than 50 employees will pay an average of almost $55,000 more per year. This is a new cost to those businesses.

- For businesses with fewer than 50 employees, the anticipated average annual tax bill is $40,040. The median for member businesses under 50 employees is $10,000.

- 28 per cent of our member businesses said they expect to reduce employee benefits because of the tax and the increased cost to their business.

- 24 per cent said they expect to reduce staff. When you isolate businesses with fewer than 50 employees, that number increases to 30 per cent.

Iain Black, President and CEO of the Greater Vancouver Board of Trade said, “The survey results today confirm what we have heard from our Members since the B.C. Budget was announced: this unexpected payroll tax will hit small- and medium-sized businesses hard. The fact that this is a tax on the amount of an organization’s overall payroll — before other taxes and any profits — eliminates any option for a business to plan for a lean year.”

Chris Gardner, President and CEO of the Independent Contractors and Businesses Association said, “Payroll taxes are job-killers, as they increase the cost of employing people and growing businesses. When you add it to the NDP’s carbon, income and other tax increases, record-high gas prices, cities passing along their own payroll tax costs through higher property taxes, and shaken investor confidence in B.C., it’s perfectly understandable that job creators are reeling. The BC NDP must rethink this tax.”

About the survey:

The member association survey was conducted online between March 21, and April 4, 2018.

The small proportion of respondents (9 per cent) who identified as self-employed or sole proprietors was excluded from the payroll tax and MSP premium calculations.

The survey was conducted by the Greater Vancouver Board of Trade and the Independent Contractors and Businesses Association in partnership with the B.C. Tourism Industry Association and B.C. Restaurant and Foodservices Association.