Today’s budget demonstrates that the Province’s commitment to balanced budgets and fiscal responsibility is paying dividends for British Columbians and for the construction industry.

“The message in this budget is clear –when governments save and spend responsibly they can cut taxes, invest in construction projects and support small businesses.” said Chris Gardner, President, Independent Contractors and Businesses Association.

“The government has rolled out an aggressive plan to build our province and to support families and small businesses.”

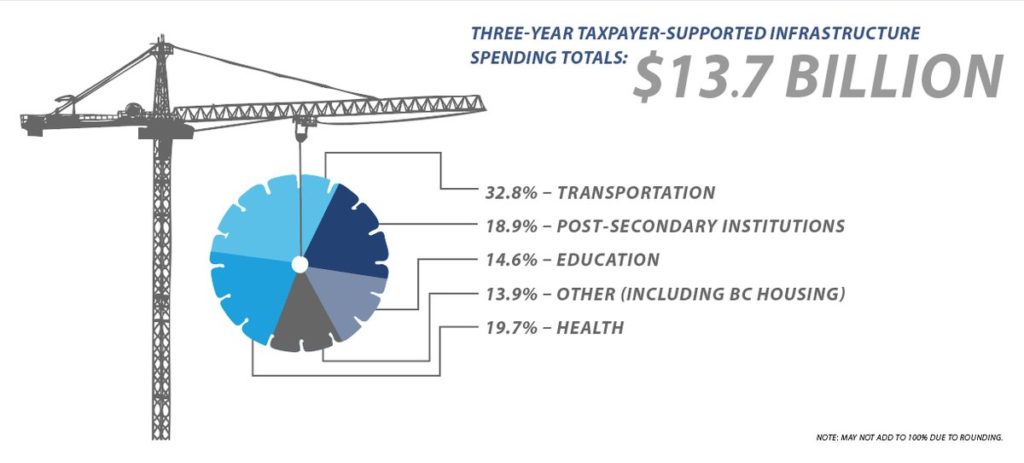

A $24.5 billion investment in infrastructure will support more than 30,000 construction jobs across BC. Investment in infrastructure over the next 3 years includes:

- $13.7 billion on hospitals ($2.7bn), schools ($2.0bn), post-secondary institutions ($2.6bn), transportation ($4.5bn) and BCH ($1.9bn).

- $10.8 billion on power projects and other transportation projects.

The construction sector in BC employs over 200,000 people and continues to grow faster than the overall economy accounting for 8.5% of the Province’s GDP. “Balancing over the past five years has given the government the flexibility to make investments that are creating jobs and driving a stronger economy,” stated Gardner.

The Province is also putting money back into the pockets of taxpayers announcing a series of important tax cuts.

- Small business tax cut from 2.5% to 2.0 percent – the second lowest in Canada.

- Elimination of the PST on electricity for businesses – starting October 1, 2017.

- A reduction in MSP premiums by 50% will help families and small businesses.

“Now is the time to build – putting money back into the pockets of families and small business owners will reap strong benefits for the construction sector in BC,” said Gardner.